Eid Mubarak. The cyclical flow of Eidi has stood the test of time. The younger kids get loads of cash, the same is gobbled up by parents, who then recirculate to other kids, and the cycle continues. As a thumb rule, infants get more Eidi than toddlers, who get more Eidi than pre-teenagers, and so on. The older you get, the less wealth accumulation there can be through Eidi.

Breaking the cycle

Break this cycle, and invest the Eidi of your kids. You start early, and you enable capital accumulation for the kid from a very early stage. Two decades down the road, the kid may thank you. Stop stealing Eidi from kids.

Invest for long-term

A child essentially has the longest time horizon and can take higher risks in terms of asset allocation. As a thumb rule, a longer time horizon implies a higher ability to tolerate risk. Think of it like this, 15 to 20 years down the road, your kid would be an adult -- and it may not hurt to have a nice micro trust fund available to them to do whatever, whether pay for graduate school or just travel for a year.

Where to invest?

Keep it simple. 100% allocation to equities. Whether you get gifts as cash for your child on their birthday, or they get Eidi, or they get whatever cash gifts on various occasions. Invest all of that. You keep investing whatever cash they get, and suddenly the amount starts compounding. You can figure out the glorious benefits of compounding here.

How to invest?

If you're new to all this, keep it simple, and invest in an equity mutual fund, or an index ETF. Open an account in the child's name, and you are good to go. You can open an account in your child’s name, and keep your name as a guardian. It is possible. Once the account is open, you can invest easily as and when the child gets any gifts, etc. Do not pay a front-end load. I repeat, do not.

Illustration

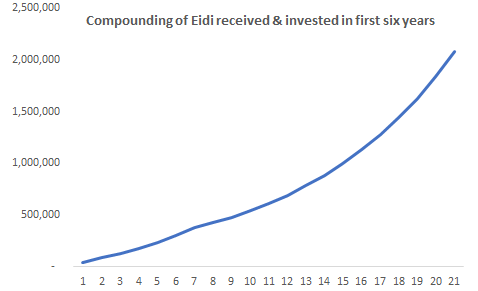

Let's say your kid gets PKR 20k as Eidi on their first eid, and maybe another PKR 20k on birth and aqeeqa, etc. From the first birthday onwards to say their sixth birthday, they get PKR 30k annually on one pretext or another. From the seventh birthday onwards, it's potentially difficult to rationalize with kids, so yea let them buy play station with that or whatever.

Compounded at 13% annually (ballpark annual return for equities) for 20 years yields a sweet PKR 2.1 million on the child's twentieth birthday. This may not be a lot, but it is quite a lot if random cash gifts and Eidi are accumulated. You literally did not put in a single rupee from your own pocket here but ensured all the gifts (until six years of age) accumulated to something meaningful.

This is a simple exercise. How random cash can be converted into long-term capital. Think about it. Your child may thank you, or not.

Is Meezan education plan(kafalah) a good option ?

Salam. Any index ETFs available to Pakistanis living in Pakistan?