The bad math of life insurance policies

The math behind bancassurance, and life insurance policies

This post may get slightly tedious due to some calculations. Take a deep breath. Maybe grab some coffee, and read through it all. You may actually save money this way. Share it with your friends, family, and everyone else, and help them save money, and not be scammed

If this is your first time here, then subscribe, and get rich, or at least don’t get scammed

The cultural underpinnings of an insurance policy

Importance of a life insurance policy has been embedded in our national psyche. A catchy jingle, pictures of a happy family, a daughter getting married (hello, patriarchy), while the son gets education (hello again, patriarchy), and a father who may just die. To ward off the misery that follows, the payout from the insurance policy will ensure that the family stays happy.

The emotional appeal of all these factors influenced people to pay annual premiums to insurance companies, who paid a hefty amount at the end of 20 or 25 years, or when the person insured died (a very very low probability in the larger scheme of things). Amidst the emotional appeal, math took a backseat, and people became comfortable with paying hefty premiums to get a payout at the end of term, which barely covered inflation. This was further compounded by Bancassurance schemes, which started selling all kinds of risky schemes to get a quick commission, while the buyers remained underwater for years at stretch. An excellent substack covering this is covered by 2paisay here.

Wonky math

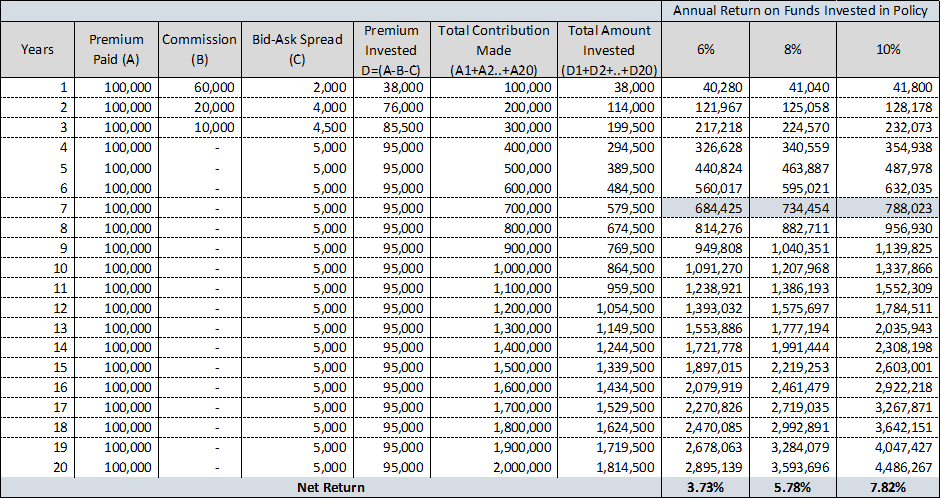

So what is wrong with the math here? Let's break it down, with real-world numbers. Let's assume you are a 30-year-old, with a spouse and a kid, and in order to hedge your death, you want an insurance policy. An insurance agent comes to you and explains that by just giving a premium of PKR 100,000 every year, you can earn an amount of PKR 2.9 million to PKR 4.5 million in 20 years. Isn’t this too good to be true? By paying an insurance premium of just PKR 100,000 every year, you can accumulate so much?! Sadly, this is a fairly bad return in this case. You should be accumulating much more. Let me try to explain why.

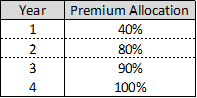

Insurance policies are notorious for up-front commissions. For the first year, the insurance company takes a commission of 60% of the premium paid. For the PKR 100,000 you paid as a premium in the first year, the insurance company takes PKR 60,000 as commission, and only PKR 40,000 is invested. Similarly, for the second year, the insurance company takes a commission of PKR 20,000, while investing PKR 80,000 – and finally, for the third year, it takes a commission of PKR 10,000, and invests PKR 90,000.

In essence, during the first three years, you may have paid actual premiums of PKR 300,000, but the actual amount invested is only PKR 199,500 – while the remaining is the commission for the insurance company. This is why insurance sales agents are incessant with their sales pitches because you’re paying their commissions.

So when do you breakeven?

In such a scenario, it is only at the seventh year mark that your insurance policy actually breaks even – which means that you may be paying PKR 100,000 every year, but only by the seventh year, the value of your policy is close to, or slightly greater than PKR 700,000 (since you’re judiciously paying PKR 100,000 every year). You ‘profit’ during the first seven years is close to zero. If there are negative returns due to a bad market, it may even be in the eighth, or ninth year that you breakeven.

More management fees

In addition to commissions, there are is another layer of fee which you would be paying, which includes a ‘bid-ask spread’, and a ‘management fee’. The bid-ask spread is basically 5 percent of whatever premium you pay every year. If you pay PKR 100,000 every year, PKR 5,000 from that is a fee for the insurance company, while PKR 95,000 is invested. Similarly, the insurance company, which is still not satiated with commissions, and the bid-ask spread, will also charge a 1.5 percent management fee on your cumulative investment. For example, if by the end of the tenth year, if the value of your investment is PKR 1.5 million, the insurance company will charge PKR 22,500 (1.5% * PKR 1.5 million) as a management fee. Although these amounts do not seem big enough on a standalone basis, if they are accumulated over a long-term or twenty years in this case – they just accumulate to something substantial.

How much do you earn in 20 years anyway?

Let’s look at the table below. Don’t get intimidated. Just follow the alphabets. “A” is simply the premium you pay every year. “D” is what actually gets invested each year. The last three columns to the value of your investment for various rates of return, i.e. 6%, 8%, and 10%. Insurance companies generally use the same rates of return. Actuals may vary.

From the table, it is clear that you only break-even around the seventh year mark. It is also obvious (compare the second row and last row) that ‘net return’ is actually much lower than the expected returns. And why is that? It is because of the loaded fee structure, which includes commissions, management fees, and bid-ask spread. So a 6% annual return would eventually be a 3.73% return for you, after adjusting for all fees, etc. Similarly, a 10% expected return would be a 7.82% return for you, after adjusting for all fees, etc.

By now, it should be clear that investing through an insurance policy results in sub-par returns. If it is still not clear, read again, or drop a comment.

So what do we do now?

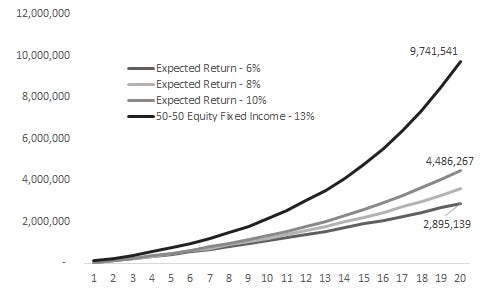

If you have been following this substack, I have specified time and again that if you are young, you have a long-term horizon, and have a higher risk appetite. It means that you can take riskier exposure in equities (stock market), and be much better off than this simulation. Even if you take a conservative stance and do a 50 percent allocation to equities (high risk), and a 50 percent allocation to fixed income (low risk), your return would still be much higher than what you get with an insurance policy. By avoiding an insurance company and managing it on your own, you can generate a terminal value of up to PKR 9.7 million, against PKR 4.4 million in best-case scenario of an insurance policy.

It should be clear from the chart above that just going for a simple 50-50 equity & fixed income portfolio would generate a much higher terminal value at the end of 20 years than it would in any case of an insurance policy. More importantly, you will have complete control of your investment and will not have for the seventh year to breakeven, and will start earning from the first day.

How we develop such a 50-50 portfolio, will be covered in the next iteration.

But what if I die?

The probability of you dying anytime soon, or within 20 years is very very low, but it is still a non-zero probability. You can also hedge for that, without getting stuck in such an insurance policy as discussed above. You buy a term life insurance policy. The cost of a term life insurance policy would be much lower than the opportunity cost of your funds accruing sub-par returns. More details on how much premium to pay for a term life insurance policy in a later iteration.

This piece should give some idea regarding how insurance policies may not provide the bang for your buck, and may just be a very lazy way to invest. Take control of your portfolio. It’s not that difficult.

Great article, Ammar Bhai! I have a few questions, if you have sometime to answer

A- What fixed income funds in Pakistan are capable of off setting the effect on purchasing power of the rupee due to double digit inflation, rising power prices and depreciation of the Rs against the USD. What is the lowest rate of return which is required to off-set these factors.

B- How do you see the stock market performing this year with all that is going on with the state bank, IMF, and the electricity prices?

I am trying to understand how both can help in the current scenario if someone is starting out right now.

C- Are there any banks in Pakistan who give you access to non-PK securities market when you maintain a premium relationship with them, like the UAE for instance.

Would love to hear your thoughts on the above. Thanks, again for taking out the time to write this blog.

Publish in a newspaper like Tribune