Congratulations. You’re an adult now.

You have graduated from college, possibly done with your graduate degree as well, and are working for a monthly salary. You're trying to figure out how to save, and how to invest, but it's all in unrelatable boomer jargon.

You may even be in mid-career, with some investments here or there, and even a Bahria Town plot -- but there is a high chance that you have an inefficient portfolio, and you can extract a higher value from it.

Maybe you're a new parent or a parent with a toddler and a six-year-old with an attitude. You want to save for them as well, such that sufficient capital is available for them to pay for college, etc., or to cover for any unfortunate event.

You may be an expat, and you have absolutely no idea how to navigate investment and savings options in Pakistan. This is the substack for you.

You want to dabble in start-ups or maybe some other private equity initiative, but don't know what needs to be done.

You can even be retired, and trying to escape from the snake oil salesmen trying to sell you high-risk schemes for a quick commission. Mostly con artists.

This space will take care of it. How to invest? Where to invest? When to invest? Cutting through the fluff and drama in between. Weekly newsletters. Delivered every Sunday, or whenever I'm bored.

Subscribe now, and get on top of your investments.

What is the objective?

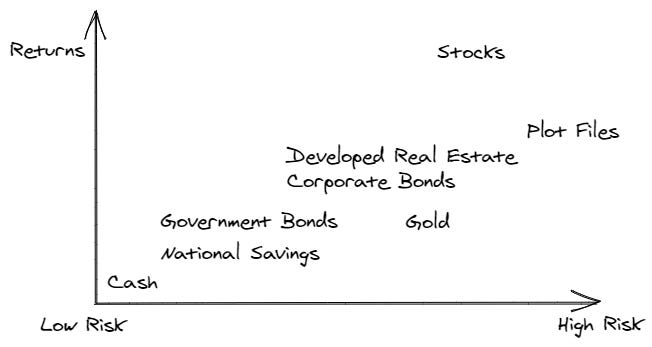

The objective is simple. You need to maximize your return, for a given level of risk. Sometimes you're not taking enough risk (with funds just lying in a Bank account), or you're taking excess risks (multiple files of Bahria Town / DHA, etc.). This is the complicated bit, you've got to manage your risks.

What is the risk?

Risk is any potential downside that there may exist. It can further be segmented into two types -- a willingness to take the risk, and the ability to take the risk. As a thumb rule, if you're young or if you have more than 15 years to your retirement, your ability to take risks is high. You can take risks, get higher returns, and so on. Because even if there is a bad year (which there always will be), you can recover from it, and not hurt overall capital (your savings) accumulated at retirement, etc. The older you get, the lower your ability to take the risk -- unless you have enough capital, then it's a different story.

Willingness to take risks refers to how comfortable you are with taking risks. Will a small temporary loss give you sleepless nights? If yes, then you need to reconcile your willingness with ability. You've got to keep things in context and look at the longer timeline.

A loss right now can be an opportunity to invest more at a lower price, and eventually benefit when prices increase again. Read this again.

Saving in small increments

As a thumb-rule, it is always better to start investing, or saving as early as possible. You don't have to stash away a lot. Even starting with PKR 500 per month is still a start.

Let's say you just graduated, and your starting salary is PKR 40k. Save 5 percent of this every month, and you're saving PKR 2k monthly. Not a lot, but let's see how compounding works its magic here. Let's also assume that your salary increases by 10 percent every year, and your monthly saving increases accordingly.

Let’s also assume an annual return on your saving of 12 percent (how we get to this figure will be covered at a later stage). At the end of the tenth year, you have saved PKR 614k, by the end of the twentieth year, it's PKR 3.5 million, and by the end of the thirtieth year, it's PKR 15 million. All by just saving 5 percent of your salary and investing that. Of course, sometimes salary increase may not be high, but in some years, it may be higher than ten percent. Sometimes, the market returns may not be 12 percent, but sometimes much higher -- it all balances out, as long as investing discipline is there.

Asset Allocation

Asset here refers to any investment you make, whether that is in a physical asset such as gold, or real estate, or stocks, etc. Asset allocation in Pakistan works on extremes. We either keep all cash stashed away under the mattress, or in a low-yield bank account, or we buy gold jewelry with it, or some plot in an obscure society in the suburbs, or worse, a file in Bahria Town/DHA, etc. Staying in cash is a low-risk allocation while going all out in real estate is a very high-risk allocation-- because you are allocating all your capital to a tract of land which you may never get to own. The concentration risk here is high.

Saving in the form of gold jewelry is also highly inefficient -- as when you go and sell that piece of jewelry, you get a haircut of 20-25% and are not able to capture the full increase in the price of gold. If you're really convinced of gold, better to buy gold bars than jewelry.

The concept of diversification and risk management escapes a typical local household. Diversification is the key here. You spread your savings across different asset classes, depending on your risk tolerance -- a mix of stocks, bank deposits, bonds, gold, real estate, cryptocurrency, and so on. Don't put your eggs in one basket -- if you do, watch your eggs closely, very closely. But how do you do that on your small salary -- this space will tell you how. Portfolio development is an ongoing process -- we are all in this together.

So what do we do now? Think about why do you want to save, and what are your goals. Do you want to save for taking a gap year in ten years, and traveling the world? Or do you want to save for your kid's education? Or you simply want to save for a comfortable retirement. Think about how much you can comfortably save in a month. Any small amount works. The objective here is to inculcate a habit of saving, and start developing a high-performing and efficient portfolio -- and more importantly, avoid con artists.

The next iteration of this substack would focus on various investment avenues, and how you as an individual can easily access them. Let’s get rich. If you like this post. Share.

Would appreciate if you can also dive into shariah-compliant investments.

Good one Ammar!